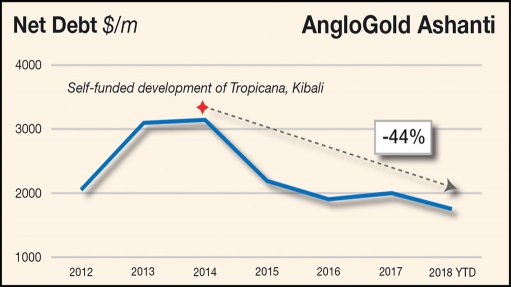

The debt reduction path of AngloGold Ashanti

Photo by: AngloGold Anshanti

JOHANNESBURG (miningweekly.com) – Production of 851 000 oz and a drop in costs helped gold mining company AngloGold Ashanti to drive net debt down by 15% year-on-year in the three months to September 30, with net debt now 44% lower in six years.

Third-quarter production of 851 000 oz was at a 14%-lower all-in sustaining cost (AISC) of $920/oz; the all-injury frequency rate of 4.17 is the lowest in the Johannesburg- and New York-listed company’s history, and South Africa’s Mponeng gold mine a standout performer, along with Kibali in the Democratic Republic of Congo, Iduapriem in Ghana and Tropicana in Australia.

“This is a strong operating result that shows our absolute focus on safety and margins,” said new CEO Kelvin Dushnisky.

Net debt to earnings before interest, taxes, depreciation and amortisation has improved to 1.13 times on net debt of $1.749-billion.

Production at Mponeng was up 25% year-on-year on higher grade and improved mining practices, taking the South African Operations as a whole to a 3%-higher 120 000 oz at 17%-lower AISC of $1 026/oz, despite a weaker performance from the surface operations.

A new shift arrangement Mponeng, as agreed with all the trade unions, is expected to result in increased face time and improved operational efficiency.

A feasibility study on expanding Kareerand tailings storage facility to allow for treatment of Vaal River tailings is expected to be submitted in the first quarter of next year.

The AachenTM high shear reactor technology commissioned at Mine Waste Solutions for the refractory portion of the feedstock is expected to improve recoveries.

A new five-year $1.4-billion multi-currency revolving credit facility has been signed to replace the $1-billion and Australian dollar revolving credit facilities.

At the Siguiri gold mine in Guinea, a new plant to process higher-grade, hard-rock material is expected to better costs and production next year.

The underground ramp-up at Kibali is expected to take full year production to 730 000 oz, while mobile equipment deliveries have begun at Obuasi gold mine in Ghana, where a $375-million mining contract was awarded to Underground Mining Alliance, which is 70% owned by African Underground Mining Services, a joint venture between Ausdrill and Barminco, both of Australia, with the remaining 30% owned by Rocksure, also of Australia.

Contract works are expected to begin in the first quarter of next year at Obuasi, which has an ore reserve of 5.8-million ounces and an ore resource of 34-million ounces.

AngloGold Ashanti placed the mine on care and maintenance in 2016 pending the commencement of the redevelopment project.

The company intends to develop a modern, mechanised underground mining operation and expects to produce first gold from the redeveloped project by the end of next year.

On the exploration front, the company remains committed to resource conversion and increasing the mineral inventory at mine sites, while progressing greenfield opportunities in strategic areas.

Former Lonmin CFO Alan Ferguson has joined the board as a new independent nonexecutive director and former Inmet Mining CEO Jochen Tilk will do so in the same capacity from January 1.