Australia's Alumina said on Tuesday it has agreed to be acquired by US aluminium producer Alcoa for a $2.2-billion all-stock buyout offer.

The terms of the deal are consistent with Alcoa's offer for Alumina announced on February 26, when Alcoa's CEO William Oplinger told analysts the deal would eliminate Alumina's overhead costs of A$12-million a year.

Under the deal, Alumina shareholders would receive a consideration of 0.02854 Alcoa shares for each Alumina share they hold, implying a value of A$1.15 per Alumina share, based on Alcoa's closing price as of February 23.

The deal, which offered a 13% premium to Alumina's last closing price on Feb. 23, has been finalised at a time when the industry is under pressure due to a weakness in prices.

Alumina shareholders would be delivered Alcoa shares in the form of CHESS Depositary Interests (CDIs), which would allow them to trade on the Australian Stock Exchange, Alcoa said in a separate statement.

Alcoa will apply for a secondary listing on ASX and commit to maintain the CDI listing for at least 10 years, it added.

"In addition, two new mutually agreed upon Australian directors from Alumina's board would be appointed to Alcoa's Board of Directors upon closing of the transaction," Alcoa said.

Once the deal closes, Alumina shareholders on the date of record will own about 31.6% of the merged entity, while existing Alcoa shareholders will hold 68.4%.

Alumina's board, including its Managing Director and CEO, recommend that shareholders vote in favour of the deal, in the absence of a superior proposal.

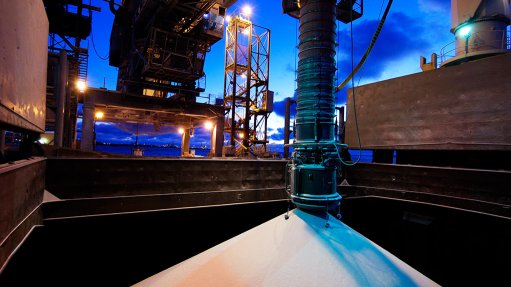

Alumina's only asset is a 40% stake in the Alcoa World Alumina and Chemicals (AWAC) joint venture, which is controlled by Alcoa and has interests in bauxite mining, alumina refining and aluminium smelting across Australia, Brazil, Spain, Saudi Arabia and Guinea.

At Alumina's request, Alcoa has agreed to provide short-term liquidity support to fund equity calls made by the AWAC joint venture if Alumina's net debt position exceeds $420-million, Alcoa said.