The Diba gold resource, on the Korali Sud licence, includes intersections of 5.36 g/t gold over 13 m and 13.88 g/t gold over 8 m

Photo by: Legend Gold Corp

JOHANNESBURG (miningweekly.com) – Africa-focused exploration project generator Altus Strategies has signed a nonbinding letter of intent to buy gold exploration company Legend Gold Corp – a TSX-V-listed company with a portfolio of gold projects in Mali.

Aim-listed Altus plans to acquire a 100% interest in Legend and is offering Legend shareholders three Altus shares for every Legend share held.

The exchange ratio represents an aggregate deemed consideration for Legend of C$5.7-million and about C$0.41 per Legend share, which is based on the Altus share midmarket price as at the close of market on October 10.

The consideration represents a premium of about 110% to Legend’s 20-day volume-weighted average price and 130% to Legend’s share price at the close of the TSX-V on October 10.

Legend shareholders will own 27.6% of Altus if the deal is concluded.

Altus CEO Steven Poulton said the company anticipated the proposed transaction to be implemented by way of a plan of arrangement; however, he noted that alternative mechanisms, such as a takeover bid, could also be considered while the parties and their respective advisers negotiate definitive documentation for the proposed transaction and complete due diligence.

LEGEND’S PORTFOLIO

Legend holds a portfolio of prospective gold exploration projects in western and southern Mali, with potential for near-term cashflow and discovery upside.

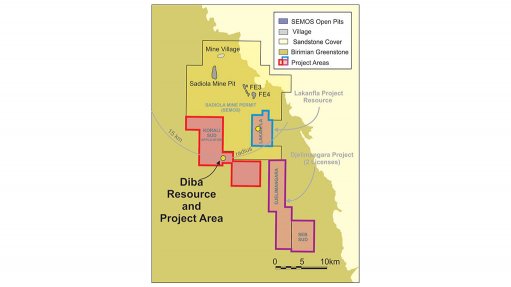

Drilling at the Diba gold resource, on the Korali Sud licence, includes intersections of 5.36 g/t gold over 13 m and 13.88 g/t gold over 8 m. Diba is located 20 km south of the 13-million-ounce Sadiola gold deposit, which is owned by Iamgold, AngloGold Ashanti and the government of Mali.

The Lakanfla licence hosts a potential karst deposit, 35 km southeast of the 4.5-million-ounce Yatela gold deposit, which is also owned by Iamgold, AngloGold Ashanti and the government of Mali.

The Pitiangoma Est licence is a joint venture with ASX-listed gold miner Resolute Mining, and is located 40 km south of the eight-million-ounce Syama gold deposit.