US uranium miner acquires idled producer as it anticipates price uptick

STEVE ANTONY It is an exciting time to be in the uranium mining sector, with increasing optimism worldwide in nuclear power generation

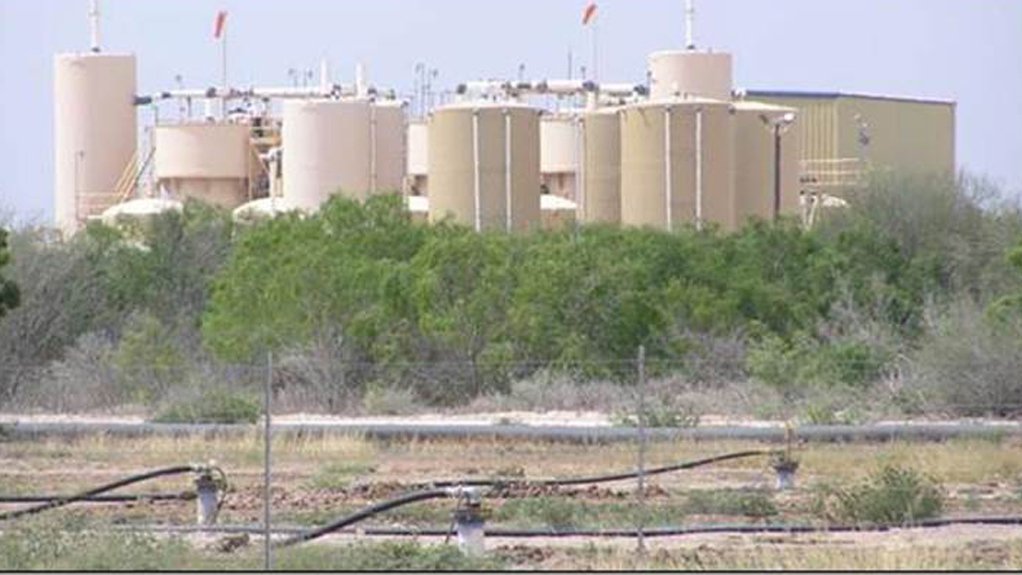

MESTEÑA URANIUM The Alta Mesa project is fully permitted, with existing wellfields and an established in situ recovery plant

US-based uranium miner Energy Fuels recently announced that it is acquiring established uranium producer Mesteña Uranium.

After closing (expected in May), Energy Fuels plans to keep Mesteña’s Alta Mesa project idle as it waits for the uranium price to increase before ramping up production.

The miner expects to acquire Mesteña this month, thereby adding to Energy Fuels’ portfolio of 12 other major uranium mines and projects. Mesteña Uranium is a bundled package of about 200 000 acres that includes the Alta Mesa in situ recovery (ISR) project, in south Texas.

Energy Fuels CEO Steve Antony tells Mining Weekly the holding costs of Mesteña Uranium are “fairly modest” at less than $1.5-million a year.

However, he says, when the uranium prices increase to, at least, the low to mid $40/lb mark, it will enable Energy Fuels to scale up production to about 500 000 pounds a year to one-million pounds a year.

“This project has produced one-million pounds a year in the past. Therefore, these levels of production are very achievable. At these levels of price and production, we would expect to realise strong margins from this project,” says Antony.

Energy Fuels acquired Mesteña Uranium because it had the foresight of uranium prices increasing significantly over the long term, he says. “Owing to the current oversupply of uranium currently . . . in the market, there is considerable uncertainty as to the timing and scale of its price recovery,” Antony states, noting that Energy Fuels, therefore, aims to realise positive cash flows across a spectrum of weak uranium price environments.

Energy Fuels’ current strategy – focusing on producing from its lowest-cost mines in the short and medium term, while permitting and developing its large-scale conventional mines to significantly increasing uranium production in the long term – is the miner’s response to the current uranium market, he explains.

“Our industry has suffered from weak uranium prices since the Fukushima disaster in 2011. Additionally, Kazakhstan significantly ramped up production during the same time when the world did not need new supply,” says Antony, adding that this resulted in the current global oversupply.

Owing to the significant global growth in nuclear energy, and restricted investment in exploration and new uranium mine development, Energy Fuels “firmly believes” that prices will increase over the long term, he avers.

Energy Fuels expects uranium prices to increase either later this year or in 2017, at which time it will aim to begin production at Mesteña Uranium.

Not including Mesteña, the miner is aiming to produce about 950 000 lb this year, with a 2017 guidance being dependant on market conditions: “. . . if prices rise to higher levels, we would likely increase production even further,” says Antony.

Mesteña’s Alta Mesa project is fully permitted, with existing wellfields and an established ISR plant. It has a current operational capacity of 1.5-million pounds a year and, with certain capital improvements, its capacity could potentially increase significantly, he adds. “There are significant in situ uranium resources and exploration potential on the 80 000 ha, to which we will have access.”

Alta Mesa will be a reliable, long-term source of uranium production, states Antony. Its operating capacity of 1.5-million pounds a year would require uranium prices to rise above the $50/lb range to operate. “If prices rise to $60/lb, I fully expect to expand the operating capacity of the plant to higher levels, ramp up exploration and significantly expand the wellfields,” Antony declares. However, these plans are currently highly speculative, he adds.

Energy Fuels’ current and future customers are major nuclear power utilities worldwide; most of its uranium is sold to US utilities, but international customers comprise about one-third of sales in 2015. Antony adds that the company is finally gaining international recognition as the main source of US-produced uranium through its aggressive growth strategy of the past few years.

Mesteña will provide Energy Fuels with another low-cost source of uranium production, while the miner’s Nichols Ranch ISR project, in Wyoming, acquired in 2015, assisted Energy Fuels in moving down the production cost curve.

Further, Antony says Mesteña has a strong foothold in the nuclear sector: “It produced about five-million pounds of uranium from 2005 to 2013, and is well-known in the US nuclear sector.”

The prospect of providing uranium for African countries interests Antony; “We are very happy to see certain African nations – and South Africa in particular – seeking to install new nuclear-generating capacity.”

He notes nuclear power generation’s reliability, affordability, 24/7 operability, zero carbon-emissions and air pollution, as well as its small plant footprint, as major benefits in comparison to other energy sources, including renewables.

Currently, at the request of customers, Energy Fuels is delivering uranium to North American and European conversion facilities. However, depending on customer needs, it can ship its products elsewhere.

“This is an exciting time to be in the uranium mining sector. There is growing optimism around the world, especially after the recent COP, 21 Summit in Paris, that nuclear power can co-exist with renewables like solar and wind to provide clean sources of energy around the clock,” concludes Antony.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation