Tawana unveils A$40m funding package from Tribeca

Australian lithium producer Tawana Resources gained on the ASX on Thursday, after announcing a A$40-million funding package from Tribeca Investment partners and others to advance its Bald Hill project and to facilitate the listing of Alliance Mineral Assets.

The company secured a A$20-million debt facility and a A$20-million standby line of credit conditional on the merger between Tawana and Alliance being implemented and the latter receiving conditional ASX listing approval.

Tawana explained that A$15-million of the debt would be used to advance the Bald Hill mine’s dense media separation (DMS) fines circuit, upgrade the tantalum circuit and for additional working capital. The remaining A$5-million of the debt facility would be used to repay the Red Coast loan.

In terms of the standby credit, Tawana explained that the funds would be available to the new group formed by Alliance and Tawana following their merger. The facility would improve the balance sheet liquidity position of the group.

The merger, announced in April, is expected to be completed in November. In terms of the scheme of arrangement, Tawana shareholders would receive 1.1 new Alliance shares for every Tawana share held, leaving both sets of shareholders with a 50% interest in the merged entity. Tawana will be a wholly-owned subsidiary of Alliance.

Tawana said that it remained committed to facilitating the listing of Alliance following the implementation of the agreement and noted that the listing application was “well advanced”.

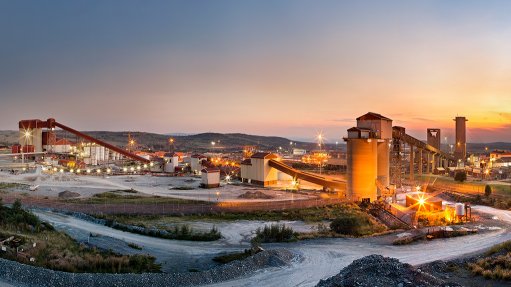

The merger is aimed at simplifying a single-ownership structure for the Bald Hill project, which is currently the subject of a joint venture agreement between the two companies.

The Bald Hill mine achieved commercial production in July this year. The company is continuing with a review to add a fines circuit and to increase the throughput of the existing DMS circuit. The addition of a fines stream will increase the current nominal 200 t/h capacity to 300 t/h, increasing total DMS circuit recovery rates and providing a significant concentrate production capacity.

Shares in Tawana traded 20% higher at 30c each.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation