Stronger-than-expected iron-ore price rally not expected to last – BMI

VANCOUVER (miningweekly.com) – The strong iron-ore price rally over the last several months is not expected to last and will gradually run out of steam over the next several years as Chinese economic growth refocuses away from heavy industry to services, dampening global demand for the steelmaking ingredient, Fitch Group-affiliated BMI Research said in a report.

Iron-ore prices are trading within a higher-than-expected trading range in the opening months of 2018 following a strong rally in November and December 2017, driven by rising steel prices.

"As a result we have revised up our iron-ore price forecast from $50/t to $55/t in 2018," the firm said. "Nevertheless, we expect prices to lose steam over the coming months as Chinese authorities continue to shift economic growth from heavy industries into services, slowing demand for industrial metals going forward. The cooling of fiscal stimulus that started in the second half of 2017 will continue, capping new demand for iron-ore as steel production slows due to a thinning pipeline of new infrastructure and construction projects."

According to high-frequency data, the final three-month average (October to December) of steel production in the country in 2017 was 3.4% year-on-year, the lowest figure of all three-month periods during that year, suggesting steel demand for iron-ore is slowing, BMI's research has found.

Similarly, while Chinese iron-ore imports grew by 5.1% year-on-year for the year as a whole, over the second half of 2017, import growth averaged a 0.8% contraction, indicating a decline in imports from the country. Further, iron-ore inventories at Chinese ports remain near record highs at 153-million tonnes, as of February, suggesting a well-supplied market.

In the long term, BMI forecasts a below-consensus price range, expecting prices to drop from $48/t in 2019 to $44/t in 2021, underpinned by a less positive outlook for Chinese growth.

China's real gross domestic product (GDP) grew by 6.9% year-on-year in 2017 and BMI's Country Risk team expects 2018 real GDP growth to drop to 6.5%. Economic growth in the country will continue to slow over the coming years (6.2% in 2019 and 5.8% in 2020) and the waning of domestic steel demand, as a result, will eventually lead to an oversupply of steel in the global market, pushing prices downwards, the analyst cautioned.

According to BMI, the strong iron-ore import demand seen in the first half of 2017 will consequently cool over the coming years as steel production growth will taper on the back of lower prices from oversupply. This will be driven by the reigning in of China's fiscal spending from 2018 onwards, which will have a direct impact on construction-based fixed asset investment, the growth of which is instrumental in driving global ferrous metals demand.

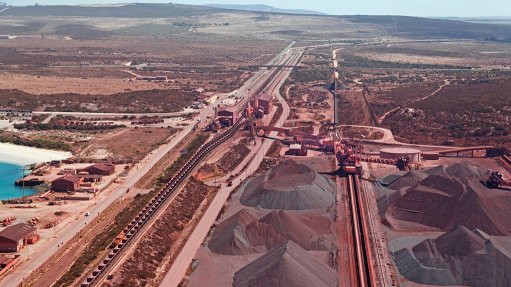

Further, on the supply side of iron-ore, consistent and large margins of major global producers, including those in Australia and Brazil with cash costs of below $20/t, will incentivise further output and mining projects, leading to further weakening of iron-ore prices over the next five years.

Globally, India will be the bright spot of iron-ore demand growth as steel production continues to accelerate. Meanwhile, US and South Korean demand growth will remain subdued due to a stagnation of steel production growth in the respective countries.

Global iron-ore production will grow modestly from 3.26-billion tonnes in 2018 to 3.38-billion tonnes by 2027.

"This represents average yearly growth of 0.5% during 2018 to 2027, which is a significant slowdown from an average growth of 4.8% during 2008 to 2017. On the one hand, supply growth will be primarily driven by India and Brazil, where major miner Vale is set to expand output with its new S11D mine. On the other hand, miners in China, which operate at the higher end of the iron-ore cost curve, will be forced to cut output due to falling ore grades," BMI said.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation