Share prices soar as Sibanye bids R4bn cash for Aquarius Platinum

The share prices of both Aquarius Platinum and Sibanye Gold rose sharply last week after precious metals mining company Sibanye offered R4-billion cash for the entire issued share capital of Aquarius – a bid Aquarius’s board has unanimously endorsed.

Aquarius’s share price rose by 36.47% on the JSE to R2.32 a share and Sibanye’s by 10.65% to R19.84 a share.

“The market clearly likes the deal,” Aquarius Platinum CEO Jean Nel commented to Mining Weekly.

JSE-listed Sibanye expects to be able to unlock synergies of R800-million a year both on a stand-alone basis and particularly when combined with the neighbouring Rustenburg platinum-group metals (PGMs) operations being acquired from Anglo American Platinum.

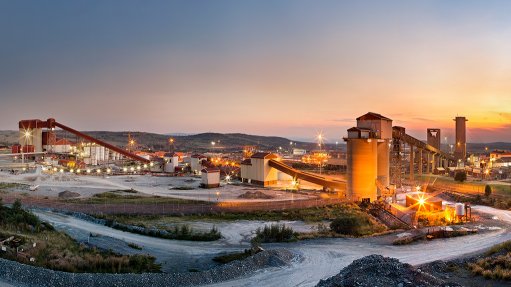

In South Africa, the Sydney-, London- and Johannesburg-listed Aquarius runs the Kroondal platinum mine and the Platinum Mile tailings retreatment operation, both near Rustenburg, and has a joint venture with Impala Platinum at Mimosa, in Zimbabwe.

Both Kroondal and Mimosa are mechanised mines, which, in the 12 months to June 30, produced 349 426 oz of four-element (4E) PGMs that included 193 422 oz of platinum.

“At higher PGM prices, these assets will substantially increase earnings for our shareholders,” Sibanye CEO Neal Froneman outlined at a media conference attended by Creamer Media’s Mining Weekly.

Froneman placed emphasis on the proposed deal fitting Sibanye’s strategy of acquiring assets that provide additional free cash flow to ensure that the company can continue paying dividends.

Aquarius has attributable 4E reserves of 5.5-million ounces and attributable 4E resources of 47.1-million ounces.

Subject to the transaction being completed, Aquarius shareholders will receive R2.66 a share at Monday’s closing prices and spot exchange rates, representing a premium of 60.3% to Aquarius’s closing share price of £0.08.

Aquarius will appoint an independent expert to determine whether the transaction is fair and reasonable and the expert’s report will be distributed to Aquarius shareholders in November.

Sibanye currently owns and operates four underground and surface gold operations – the Cooke, Driefontein and Kloof operations, in the West Wits, and Beatrix, in the Free State.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation