Perseus sinks deeper into the red

PERTH (miningweekly.com) – Dual-listed gold miner Perseus Mining has doubled its after-tax loss, with the company reporting a net loss of A$76.1-million in the 12 months to June, compared with a net loss of A$35.6-million in the previous financial year.

The ASX- and TSX-listed company on Wednesday reported that the increase in the net loss resulted from an A$11.7-million foreign exchange loss, compared with a gain of A$9.2-million in 2016, as well as a loss of A$27.5-million arising from the 2016 acquisition of Amara, a write-down of A$16.1-million incurred on the tenements in Ghana, a reduction in the carrying value of low-grade stockpiles and a depreciation and amortisation expense of A$56.2-million.

Revenue for the financial year increased by 14.2%, from A$252.2-million to A$287.9-million.

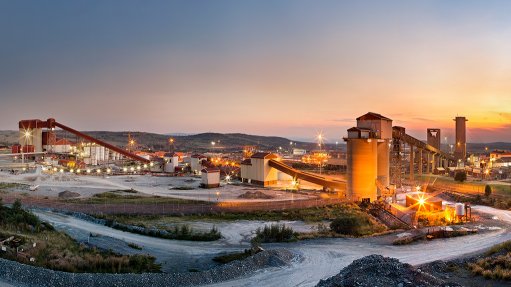

Perseus’s cornerstone Edikan mine, in Ghana, produced 176 217 oz in the full year, on the back of a strong second half, as mining rates increased, along with higher head grades and improved plant throughput and rising recoveries following a significant capital works programme completed in December last year.

“The 2017 financial year was challenging in many respects as reflected by today’s financial results,” said MD Jeff Quartermaine.

“However, having turned the corner in late 2016, we have continued to make steady progress during the first half of 2017 and we remain on track to become a multi-mine company consistently generating significant positive cash flows in the near term.”

Looking ahead, Perseus said it expected gold production in 2018 to reach between 250 000 oz and 285 000 oz, as output from Edikan was projected to increase and the Sissingue mine, in Cote d’Ivoire, started production in the March quarter.

The development of the Sissingue project remained on schedule and on budget, with project development being funded through a $40-million project debt finance facility provided by Macquarie Bank, as well as cash reserves.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation