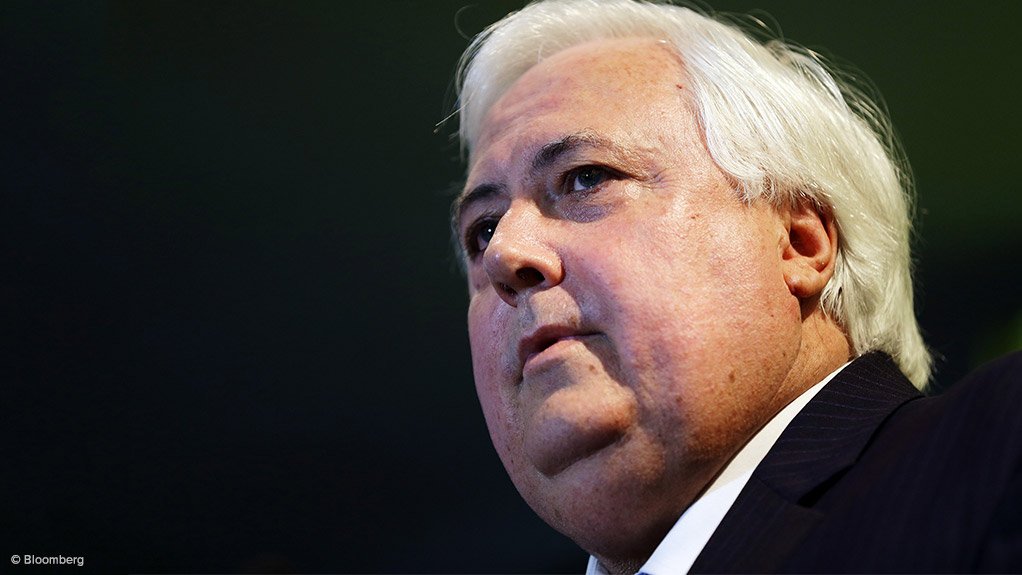

Palmer’s Mineralogy to terminate Citic Pacific’s mining right

PERTH (miningweekly.com) – Mining magnate Clive Palmer’s Mineralogy on Friday announced that it had served a termination notice to China’s Citic Pacific, giving that company a 21-day notice terminating the mining rights over the Sino iron-ore project, in Western Australia.

Mineralogy said that the termination notice to its Chinese partner was issued after the Hong Kong government started legal proceedings against the former Citic Pacific chairperson and five former directors, on governance and market disclosure concerns.

Mineralogy has been on a warpath with Citic Pacific for some time now, with the miner filing an application with the Federal Court to have subsidiary Sino Iron placed into liquidation for nonpayment of funds.

Mineralogy leased the Sino iron mine site to Citic Pacific, which acquired the right to mine two-billion tonnes of magnetite ore in the Pilbara from Mineralogy, between 2006 and 2008. During 2012, the company exercised its option to acquire the right for another one-billion tonnes.

However, in 2012, Citic Pacific received notices from Mineralogy alleging that terms in the mining right and site lease agreement had been breached, with Mineralogy maintaining that it was entitled to a royalty payment of 3c/t of all material taken from the mine area, including waste material.

“Not only has Citic Pacific failed to rectify the defaults in the notice, the directors of Citic Pacific failed to declare the default notice to the market in Hong Kong and may have breached the law,’’ said Mineralogy director Clive Mensink.

“Not only has Citic Pacific failed to disclose important material facts to the market, they have sought suppression orders and obtained Australian court orders to suppress information from the market and Citic Pacific shareholders.

“The current board is suppressing information in the same way the former board did. Five of those directors are now facing action from the Hong Kong authorities,” Mensink said.

He called on the Hong Kong Stock Exchange to immediately start an investigation into Citic Pacific’s alleged failures and that of its directors to declare the default notice in 2012, and the current termination notice to the market in accordance with the law and rules of the exchange.

Mensink said despite the fact the notice of termination was served on Citic Pacific on September 12, the directors had failed to make a public announcement or inform the market.

“The Sino iron project has a capital cost of more than $8-billion and the failure of the directors to inform the market could be a criminal offence,’’ he said.

He further noted that Mineralogy had evidence that the current board of directors’ accounts from Citic Pacific had misled the market and Mineralogy was considering making a complaint to the Hong Kong authorities.

Meanwhile, Citic Pacific said it was surprised by Mineralogy’s action, as the Western Australian Supreme Court was scheduled to hear an application on Friday to restrain Mineralogy from taking further steps against Citic Pacific regarding the notices issued.

“Citic looks forward to this matter being resolved by the Court,” the company said in a statement.

“Mineralogy has been restrained by the court or has undertaken to the court not to rely on several default and termination notices on three separate occasions over the past two years.

“In addition to the $415-million paid by Citic to Mineralogy to acquire its rights at the Sino iron project, all royalties that are owed and calculable have been paid in full by Citic to Mineralogy,” the Chinese firm added.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation