Oz focuses on acquisitions, corporate structure to survive commodity slump

PERTH (miningweekly.com) – ASX-listed Oz Minerals on Monday announced plans to cut the fat and focus on acquiring value accretive assets, as CEO and MD Andrew Cole seeks to create a company that can survive the commodity slump.

“The resource sector and cycle is shifting rapidly. Oz Minerals’ response is to become a leaner, highly agile and decisive company focused on growth and creating long-term value,” Cole said.

A three-month whole-of-company review resulted in Oz Minerals taking the decision to implement a company-wide restructure to create a decentralised business, with a corporate division focusing on strategy execution and an assets division focusing on operational delivery.

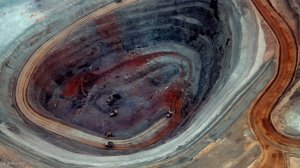

Contracts would also be managed to maximise value for Oz Minerals, with focus being maintained on achieving reliable and predictable production from the Prominent Hill mine, in South Australia.

“We have, and will continue to make changes across the entire business from a position of operational and balance sheet strength. Our new strategy will touch every part of our operation and demand a new way of working,” Cole said.

“The company is ideally positioned to maximise cash generation from Prominent Hill as openpit waste movement falls and copper production continues at a strong run-rate.”

In addition to the corporate restructure, Oz Minerals was also targeting the acquisition of value accretive assets, in Australia and globally, with the company expanding its search criteria to include other base metals and gold, where Oz Minerals’ core capabilities would be easily transferable.

Cole said that the company would pursue and develop a balanced asset pipeline with a renewed focus on operations currently generating cash, or which would be capable of doing so in a reasonable period of time.

“Changes in the resources cycle bring opportunities and this strategy is about ensuring we have the foundation and appropriate culture and discipline to capitalise on those,” Cole said.

Furthermore, the company also implemented a new dividend policy, targeting a minimum shareholder return of 20% of net cash generation not required for investing or balance sheet activity.

The whole-of-company review followed on from an earlier roll-out of strategic changes, which included the divestment of Oz Minerals’ Sandfire Resources stake, the restructuring and relocation of its corporate offices, initiatives to enhance the Carrapateena resource, in South Australia, and the suspension of the Carrapateena sales process.

These early decisions were expected to deliver cost savings of some A$44-million.

Meanwhile, Oz Minerals on Monday also announced a strong start to the 2015 financial year, with copper production reaching 31 160 t during the three months to March, while gold production reached 32 874 oz.

This was compared with the 26 002 t of copper and 36 288 oz of gold delivered in the previous quarter.

Gold production during the March quarter was lower than the previous quarter owing to copper feed being prioritised, as well as lower milled gold grades and less gold-only ore in the mill feed.

C1 cash costs for the quarter were lower, compared with the previous quarter, declining from $0.83/lb reported in the December quarter to $0.63/lb, owing to lower underground costs, higher copper production and a lower Australian dollar. This was partially offset by lower by-product credits from the lower gold production.

Looking ahead, the Prominent Hill mine was expected to produce between 110 000 t and 120 000 t of copper during the full 2015, and between 100 000 oz and 110 000 oz of gold, while C1 costs were expected to be between $0.80/lb and $0.95/lb.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation