McEwen swings back into the black on strong asset performance

VANCOUVER (miningweekly.com) – Precious metals producer McEwen Mining has reported a profit of $21.1-million, or $0.07 a share, for 2016, compared with a net loss of $20.5-million, or $0.07 a share, in 2015.

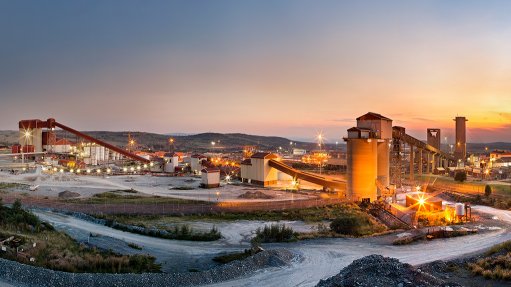

The Colorado-incorporated miner, which operates the El Gallo mine, in Mexico, and has a 49% interest in the San José mine, in Argentina, on Wednesday attributed the improved results to the strong financial performance achieved at both mines.

Net cash generated by operations for 2016 increased to $25.2-million, compared with $15.6-million in 2015. For 2016, San José mine contributed $17.7-million in dividends to operating cash flows, compared with $500 000 in 2015; and the El Gallo mine contributed $59.5-million in gold and silver sales to operating cash flow, compared with $70.2-million in 2015.

Consolidated gold equivalent output in 2016, at a silver-to-gold ratio of 75:1, totalled 145 530 oz, comprising 90 264 gold equivalent ounces (GEOs) attributable to the company from San José mine, and 55 266 GEOs from the El Gallo mine.

Consolidated gold equivalent sold totalled 144 048 oz, comprising 48 902 GEOs from El Gallo mine and 95 146 attributable GEOs from San José.

Revenue fell 17% year-on-year to $60.39-million.

As of February 27, McEwen held cash, investments and precious metals valued at spot prices of $55.2-million, with no debt.

The company plans to produce 50 000 oz of gold and 3.3-million ounces of silver from the San José mine this year, and 49 700 oz of gold and 24 000 oz of silver from the El Gallo mine. This represents expected consolidated output of 144 000 GEOs, just short of the 2016 total.

For 2017, total cash costs and all-in sustaining costs (AISCs) at the El Gallo mine are forecast to be $760/GEO and $900/GEO, respectively, which is higher than the 2016 totals of $524/GEO and $610/GEO; and total cash costs and AISCs at the San José mine are forecast at $780/GEO and $990/GEO, respectively, up from $760/GEO and $954/GEO during 2016.

Chairperson and chief owner Rob McEwen noted that, pending government approval, the company is ready to start construction at the Gold Bar deposit, in Nevada, late this year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation