Ivanhoe shares hit by funding uncertainty for DRC copper projects

TORONTO (miningweekly.com) – Africa-focused project developer Ivanhoe Mines said on Thursday that it did not have enough money to meet certain objectives at its two base metals projects in the Democratic Republic of Congo (DRC), unless it received a significant cash injection before the end of the current quarter.

The project developer said that it had available consolidated working capital of about $149.8-million at the end of March, compared with $201.7-million at December 31, adding that it would focus the bulk of the capital on pushing forward with the bulk-sampling shaft at the Platreef project, in South Africa’s Limpopo province.

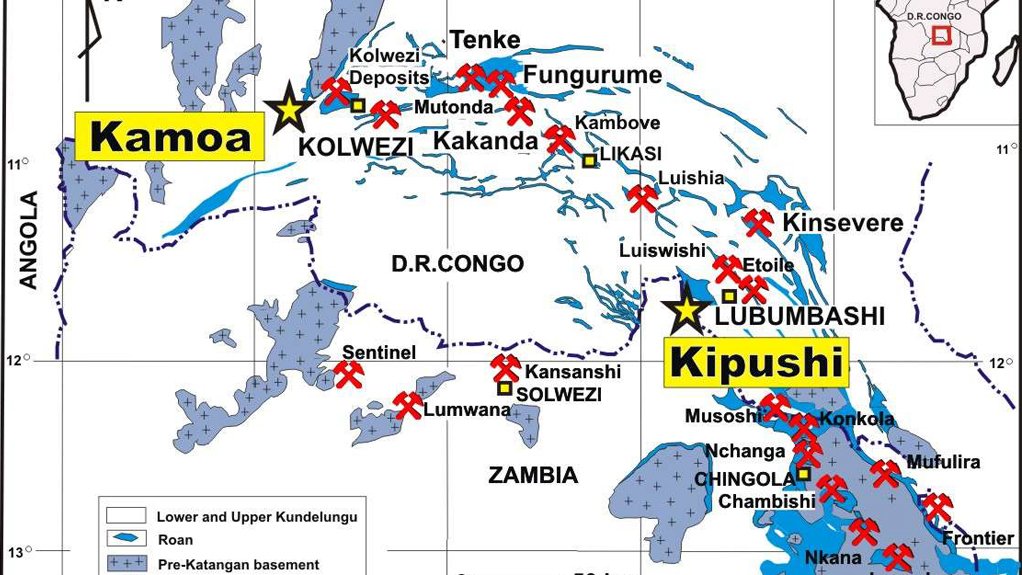

The company, founded by billionaire mining legend Robert Friedland, said it had $145.2-million available to spend on the Platreef project, which would sustain it through to early next year, and $4.6-million for the DRC projects, which is insufficient to start the underground mine-access decline at the 95%-owned Kamoa project and implement an underground drilling programme at the 68%-owned Kipushi project.

“The company does not have sufficient funds to meet these objectives at Kamoa or Kipushi without further funding by the end of the second quarter. Any future working capital deficiency is expected to be remedied through a debt or equity financing.

“The company's access to financing is always uncertain and there can be no assurance that additional funding will be available to the company in the near future,” Ivanhoe said in a statement.

Ivanhoe said that in order to help realise the potential value of its world-scale African projects, it is looking at a number of potentially significant corporate and project-level options, including a corporate reorganisation; project spin-offs (including potentially separating its South African platinum assets and its DRC copper and zinc assets into separately listed public companies); sales or joint ventures; project- or corporate-level debt and/or equity investments (including interim financing); and additional and/or alternative stock-exchange listings for certain of the company's projects.

Last year, Ivanhoe raised C$108-million to spend on its DRC projects, and Friedland himself subscribed for C$25-million of the offering.

Ivanhoe in November said it would need $1.4-billion to bring the Kamoa project on line, while a March preliminary economic assessment found it would need about $1.7-billion to bring the 90%-owned Platreef project to production. A Japanese consortium comprising Itochu Corporation; Japan Oil, Gas and Metals National Corporation and JGC Corporation owns the other 10% of the project.

The news sent its TSX-listed shares falling by as much as C$0.31 apiece on Thursday, before regaining some ground to close at C$1.51 apiece.

Friedland made a name in 1996 by selling a then-undeveloped Canadian nickel/copper project called Voisey's Bay for C$4.3-billion.

He solidified his near-legendary status within the mining industry with Ivanhoe Mines, a vehicle he used to promote and build the goliath Oyu Tolgoi copper/gold mine in Mongolia. In 2012, mining giant Rio Tinto acquired a majority interest in Ivanhoe, which is now called Turquoise Hill Resources.

That deal allowed Friedland to concentrate on Ivanplats (which had subsequently been renamed Ivanhoe Mines), taking it public in 2012 in one of the most closely followed initial public offerings of the year. The partial offering raised about C$300-million.

STAFF MOVEMENTS

Earlier this month, Ivanhoe appointed senior South African mining executive Mark Farren as the company's executive VP of operations, effective from June 15. He would be tasked with responsibility for the various engineering and development activities at the Kamoa, Kipushi and Platreef projects.

He would also assume the main duties presently performed by COO Michael Gray, who would retire from his day-to-day role with Ivanhoe at the end of June. Gray would continue to advise the company on mining-related matters as a consultant.

Executive VP and chief development officer Steve Garcia, who helped establish the foundations for Ivanhoe's corporate growth and project development, resigned from the company at the end of April.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation