Input costs weigh heavily on Zambia’s mines – ZCM

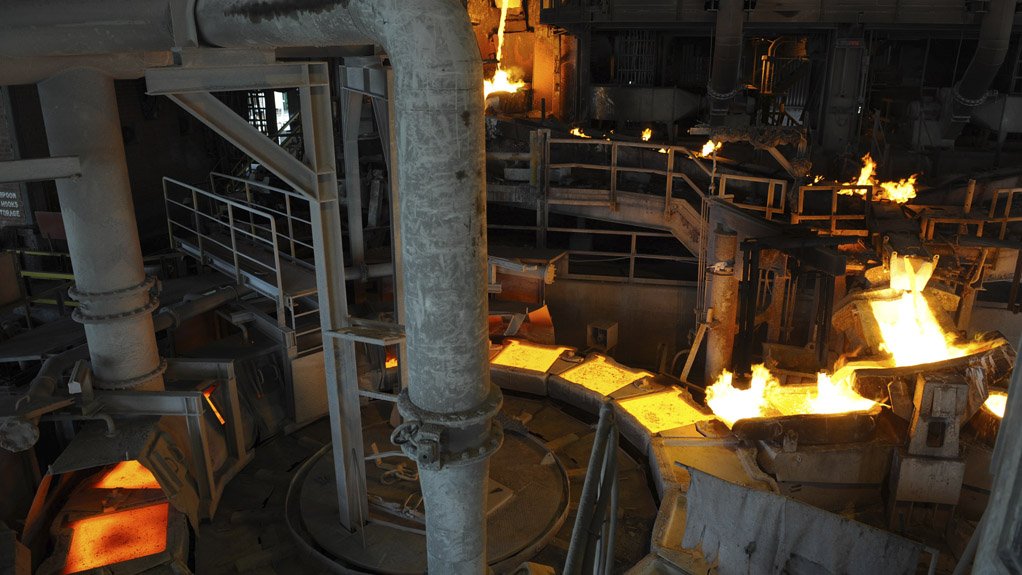

MAJOR COST COMPONENT By virtue of the extensive mechanical and heat-treatment work involved in producing finished metal, mining is one of the most energy-intensive industries worldwide

MOPANI MINE Mopani runs four shafts at its Nkana mine site and another shaft and an incline at its Mufulira mine site

Electricity and labour, which together account for up to 50% of total operating costs, are the most important elements in the cost structure of the average Zambian copper mine, states the Zambia Chamber of Mines (ZCM).

This means that even small increases in these two cost components can have a disproportionate effect on a mine’s overall cost structure and, in extreme cases, can push a mine from profitability into loss virtually overnight.

The ZCM elaborates that, by virtue of the extensive mechanical and heat-treatment work involved in producing finished metal, mining is one of the most energy-intensive industries worldwide. Moreover, the chamber notes that, while the global mining industry has become highly mechanised through advanced technology and machinery, it still employs large numbers of highly skilled people.

Therefore, the wage bill for a typical Zambian mine represents around one-third of total costs and is as high as 50% for some of Zambia’s older mines. Diesel fuel, which is used to power vehicles, equipment and machinery, is also a big cost component. For example, a large openpit mine, such as base metals miner First Quantam Minerals’ (FQM’s) Kansanshi copper mine, in Solwezi, goes through about 200 000 ℓ of diesel fuel a day, which equates to a significant fuel spend.

The ZCM highlights that other costs borne by Zambia’s mines are for explosives, maintenance of machinery and equipment, consumables, including spare parts and various support services, and administration charges.

“To produce finished metal in a competitive global market, mines constantly walk a tightrope between revenue and costs,” says FQM Sentinel mine commercial manager John Dean. He remarks that mines have no control over certain factors, such as the copper price, however, the ones that can be controlled, such as operational costs need to be managed studiously and meticulously.

Dean says that electricity costs and erratic supply are well-known subjects of conversation in Zambia’s current load-shedding environment, noting that what is less known is that fuel costs are also significant.

He says Zambia’s fuel prices are among the highest worldwide, mainly because of inefficiencies in the national procurement system and the monopolies enjoyed by the outdated 1 710 km Tanzania-Zambia Mafuta crude oil pipeline and Zambian crude oil refining services provider Indeni Oil’s refinery, in the city of Ndola.

“It is heartening that Finance Minister Felix Mutati has acknowledged these inefficiencies in the recent 2017 Budget Speech, when he announced that government was getting out of the business of fuel procurement from March and handing it over to the private sector,” says Dean.

He adds that the current high price of diesel feeds not only into daily running costs, but also transportation costs, both for trucking copper out of Zambia to the nearest ports for export overseas, and for importing equipment, machinery and spare parts.

Dean comments that these imports, which can run into hundreds of millions of dollars a year, attract both value-added tax and import duty, which is as high as 25%. “Import duties are very high and we pay it on virtually everything, including many products that cannot be sourced from local manufacturers,” he points out.

Further, the ZCM highlights that other costs that mining companies have to deal with include the country’s Mineral Royalty Tax (MRT), which is effectively a cash cost paid on every ton of copper produced, depreciation and bank financing costs, which makes keeping a mine operating sustainably “a fine juggling act”.

Base metals mining company Metorex’s Chibuluma copper mine CFO Eustus Munsaka says a common misconception among industry observers is to see only the obvious, direct costs of mining. “It is like seeing only the tip of the iceberg, without realising that there is more underneath the surface. Mines constantly walk a tightrope between revenue and costs.”

He says that, if one has to look at costs holistically and see the overall picture, which includes the costs the ZCM details, not to mention corporate social responsibility budgets.

Munsaka states that a mine’s overall cost structure is also affected by its size, its design and the peculiarities of its geology. For example, access to Chibuluma’s underground operations is through a decline or tunnel, rather than expensive shafts and unlike other Copperbelt-based mines, it is fairly “dry”. Therefore, there is no need for expensive operations to pump water to the surface.

Moreover, he notes that Chibuluma produces a “very modest” 10 000 t of copper a year and runs a fairly compact processing plant. “These three factors combine to produce a lower energy requirement, compared with other much larger Copperbelt-based mines,” he points out.

However, conversely, Munsaka notes that the mine’s declines produce challenges of their own, such as damage to the expensive tyres of the loaders, as well as broken-down vehicles, which can block the tunnels and cause costly work stoppages. “We have always considered ourselves a low-cost mine. Nonetheless, in the current low copper price environment, we are in survival mode and are carefully controlling our costs,” he emphasises.

Diversified mining and marketing company Glencore’s Mopani copper mine, which is also located in the Copperbelt, is at the other end of the cost spectrum. Mopani runs four shafts at its Nkana mine site and another shaft and an incline at its Mufulira mine site.

“We are a high-cost mine, but that is in the process of changing. Mopani is in the midst of a $1-billion modernisation programme aimed at improving its productivity and bringing the mine’s overall cost structure down,” highlights Mopani CFO John Chiwele.

He points out that Mopani’s shafts were built in the 1930s and, despite being very well maintained, the fact remains that they are old infrastructure. “We have to travel further to access the orebody, which requires more effort and this causes more frequent equipment breakdowns to occur.”

Chiwele also notes that the ore grades decrease in most cases, the lower a shaft goes, which means the mine has to produce more ore to make profits, while water pumping and ventilation costs also increase. Therefore, generally more mine maintenance is required, which adds to operating costs.

Mopani is currently sinking three new shafts: two at Nkana mine site and one at the Mufulira mine site. This will address the problem of old infrastructure and also reduce the ore-handling times from the old mines.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation