Golden Star to explore potential new gold sites in Ghana

EIGHT IN 2018 Golden Star Resources will explore eight potential gold sites and assess the viability of mining the sites

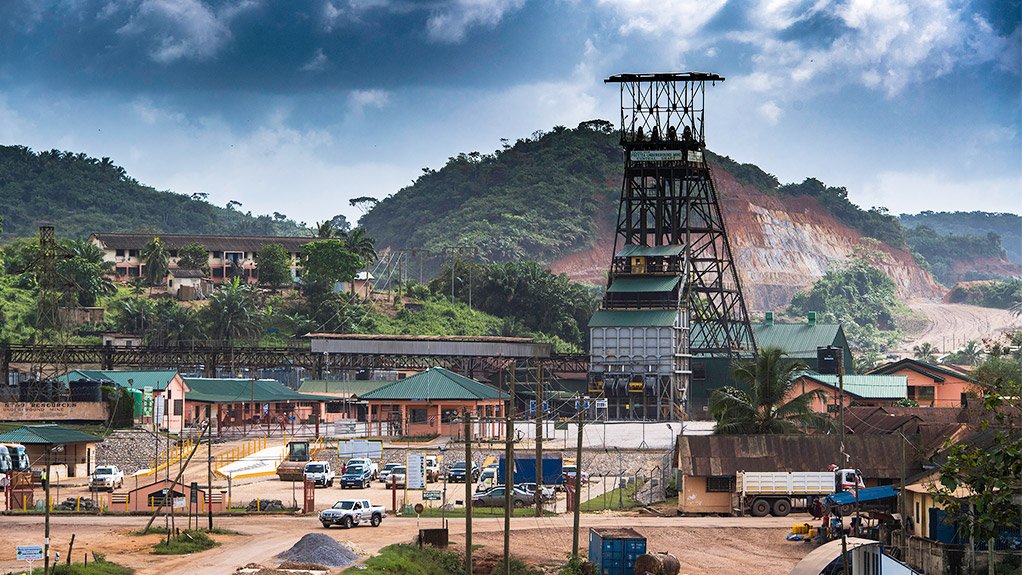

Canadian gold miner Golden Star Resources, as part of its exploration strategy for 2018, will focus on understanding the deposits at the Wassa Underground gold mine, continue mineral resource expansion drilling at the Prestea Underground gold mine and investigate five new underground targets, all in Ghana.

The objective of the strategy is to investigate the potential to increase Golden Star’s high-grade, low-cost production profile and to extend the life-of-mine of the Wassa and Prestea mining complexes.

“The initial results from the 2017 exploration programme demonstrated that Wassa Underground remains open to the south and, in 2018, we will be doing further work to assess the scale of the deposit at depth,” Golden Star president and CEO Sam Coetzer said in February.

Phase 1 of the 2018 exploration strategy has a budget of $6.6-million and will focus on about 46 000 m of drilling. The budget includes drilling and assay costs, but excludes fixed exploration costs. Phase 2 of the strategy will depend on the initial drill results.

Wassa Underground

Golden Star’s primary exploration focus falls on the Wassa Underground mine and will make use of 36% of the 2018 budget.

Previous drilling results have confirmed that the B Shoot extends about 50 m north of the planned stoping area and the B and F Shoots extend 180 m south of Wassa’s inferred mineral resources. In 2018, the drilling target aims to delineate the extensions at the B and F Shoots’ inferred mineral resources. Phase 1 of deep drilling is expected to cost $2.4-million, and 11 665 m of drilling is planned.

Prestea Underground

Exploration at Prestea will focus on the West reef and Main reef at the underground mine, with the objective being to test for further mineral reserves.

At the West reef, the objective is to demonstrate that the orebody reaches beyond the mineral resource estimate. The main target will be the projected plunge extensions at the West reef.

At the Main reef, drilling will test for potential mineral resource addition. Testing at levels 17 to 24 has previously not been undertaken, owing to the lack of underground infrastructure. If the drilling is positive, there is an opportunity to include material from the Main reef into the mine plan in the medium term.

Phase 1 at Prestea is expected to cost about $2.8-million.

Golden Star believes that the expansion of Prestea’s underground mineral resources will “provide compelling potential for increasing near-term production”.

New Targets

Golden Star re-evaluated previously known exploration targets and identified five new underground targets for gold reserves. These targets are within trucking distance of either the Wassa or Prestea processing plants.

Of the five potential underground prospects, three will be drilled: 2 500 m will be drilled at the South Gap, 3 800 m at Mansiso and 5 250 m at 242 FW at a total cost of $1.4-million.

Nevertheless, first priority for the miner are the Father Brown and Adiokrom deposits. These deposits are nearly 85 km south of the Wassa processing plant and a haul road is already in place. These deposits were last mined by Golden Star in 2014, however, high-grade mineral resources remain within the deposits.

These resources have the potential to be mined through underground techniques. No drilling will take place at these deposits, but Golden Star is planning a conceptual block model that will form the basis of a mining plan – which might necessitate further drilling.

The second priority is the 242 FW target in the western limb of the Wassa deposit scale fold. The 242 FW target was discovered in 2017 and the drilling this year will be the first investigation into the potential of the footwall horizon and the extent of the target. Drilling is expected to cost about $660 000.

The third priority is the South Gap, a 2-km portion of the Ashanti Gold Belt, at the extreme southern end of the 9 km strike of the historical Prestea underground workings. South Gap is between the Bondaye and Tuapim shafts.

In 2017, seven holes were drilled in the area and initial tests indicate gold recoveries of more than 85%. This confirms the material is nonrefractory. A further 2 500 m of drilling to test the extents of the mineralisation is planned for 2018.

Mansiso, the fourth priority for Golden Star, is about 30 km north-east of the Bogoso processing plant. About 3 800 m of drilling is planned at the target in 2018 to define the inferred mineral resources and assess the viability of underground mining.

Lastly, there is the Subriso West target, which is located about 50 km along the Hwini-Butre Benso haul road, south of the Wassa processing plant. Drilling will not be conducted at this site – rather a conceptual block model will be constructed. As with the Father Brown and Adiokrom deposits, drilling will depend on the model.

“I look forward to releasing the drilling results as our focus turns to expanding our high-margin production profile and increasing the lives of our mines,” Coetzer concluded.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation