Firestone narrows H1 loss, says Liqhobong on track for commercial production in June

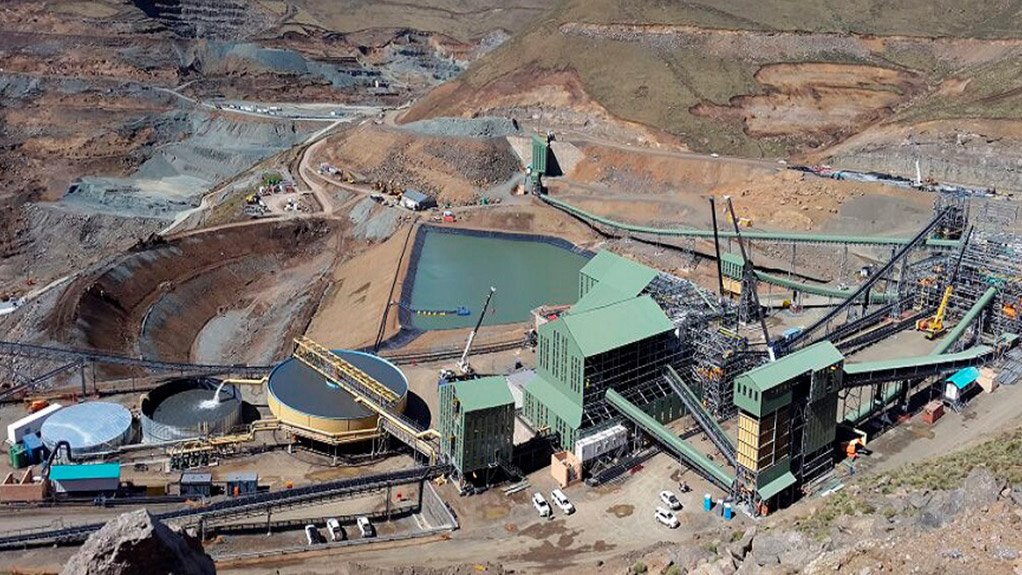

JOHANNESBURG (miningweekly.com) – Aim-listed Firestone Diamonds, which on Tuesday posted a $4.1-million loss before tax for the six months to December 31, expects its Liqhobong diamond mine, in Lesotho, to reach commercial production at the end of June.

Commissioning of the mine started in October 2016, with the mine construction completed on time and within the $185.4-million budget.

In a conference call from London, on Tuesday, Firestone CEO Stuart Brown commented that finishing construction of the mine and starting production in October 2016 were “two momentous milestones” for the company.

“This has been a very successful project from a construction and commissioning perspective. To have completed the project within the budget in a very difficult environment and without any lost time injuries, makes us all very proud.

“We look forward to the continued trend of overachievement that we have demonstrated throughout as we continue with our ramp-up phase. Importantly, we are now working towards achieving commercial production in the coming months,” Brown said.

CFO Grant Ferriman said the Liqhobong plant had operated consistently at more than 200 000 t/m and was now gearing up towards the 300 000 t/m nameplate capacity.

“We certainly think that achieving commercial production by end-June is achievable,” he said.

Nameplate capacity at the mine has been achieved on multiple occasions and 402 440 t was treated up to December 31, with more than 57 000 ct recovered. A 37 ct white diamond, alongside a further 20 special stones larger than 10.8 ct, as well as several fancy yellow diamonds were recovered during the six months under review.

“Despite starting our production on treating lower-grade ore and old mixed stockpile material, we recovered some high-value diamonds that have encouragingly achieved very good prices at our first two sales in Antwerp in February and March,” Brown said.

The two sales generated proceeds of $13.7-million from the sale of 127 590 ct at an average price of $107/ct.

Brown further highlighted that the latest sale included an exceptional purple diamond, a blue diamond, a lilac diamond and several pink diamonds.

Although small, Brown believed the presence of these diamonds were an indication that the orebody had the potential for a diverse range of good quality, high-demand diamonds.

He relayed that the mine’s ramp-up process had not been without challenges, with heavy rainfalls and some plant and equipment teething problems experienced initially.

“Pleasingly, these have largely been resolved,” he said.

Initially, grades were also negatively impacted on by the underrecovery of the lower value finer diamonds. Optimistic nonetheless, Brown noted that the grade was steadily improving as minor modifications continued to be made to the plant and were expected to improve as the mine started treating the better-quality ore.

“The waste stripping is on schedule and we are now in the process of dewatering the south-eastern side of the main pit, to begin accessing better-quality ore later in the financial year. We expect the mine to improve steadily . . . in the coming months,” Brown said, adding that the plants were running at more than 500 t/m.

FINANCIAL PERFORMANCE

Meanwhile, Firestone’s $4.1-million loss before tax was slightly lower than the $4.6-million loss recorded in the six months to December 31, 2015, and was the result of a deferred tax charge during the period under review of $4.6-million.

Its net loss for the six months under review was $8.8-million.

The deferred tax charge resulted from foreign currency translation gains at Liqhobong. The Maloti, Liqhobong's functional currency strengthened against the US dollar by 7.9% during the period, which resulted in a lower value of debt in Maloti currency terms at the end of the period and taxable foreign currency translation gains for the period.

However, Firestone noted that the group’s finances were well managed with sufficient cash and debt facilities available to fund the group for the foreseeable future, with total available debt facilities of $29.0-million and cash of $3.3-million.

DIAMOND MARKET

Brown noted that the overall diamond market remained fairly difficult, although prices for the larger and better-quality diamonds continued to be strong.

“The impact of the Indian demonetisation event towards the end of the period has negatively affected the lower-quality, high-volume, end of the diamond market,” he said, explaining that the impact of this had meant that prices for these goods had weakened, while in some cases the very poor quality goods had remained unsold.

Brown said it was not certain how long this situation would continue for, but noted that there were some signs that pricing was improving in these categories.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation