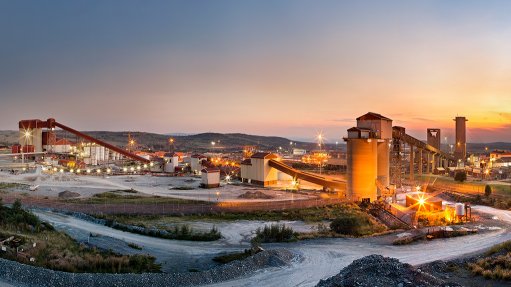

Economics improved at Jameson's Crown Mountain

PERTH (miningweekly.com) – ASX-listed coal developer Jameson Resources has revealed that despite the fall in coal prices, the Crown Mountain coking coal project, in British Columbia, retained its attractiveness.

Jameson on Monday noted that even at the recent benchmark price of $109.50, the Crown Mountain project still had margins ranging from between 54% and 25%, making the project economically attractive.

Furthermore, global macroeconomic events, including the changes in foreign exchange rates, lower oil prices, lower equipment prices and a loosening in the labour market, have all had a positive impact on the project’s economics.

A 2014 prefeasibility study (PFS) estimated that the Crown Mountain project would have a net present value of about $369-million, an internal rate of return of 33% and a payback period of 2.7 years.

Based on a resource estimate of 23.7-million tonnes, the project was expected to have a base case production of between 1.5-million tonnes and 2-million tonnes of coal a year over a 16-year mine life. Start-up capital for the project has been estimated at $339.7-million.

The PFS also estimated a life-of-mine free-on-board (FOB) cost of $100.38/t, while the first four years of production would have a FOB cost of $88.64/t. However, Jameson noted that adjusting these figures to the current exchange rates yielded a life-of-mine (LoM) FOB cost of $87.28/t, and an initial FOB average of $70.91/t during the first four years of production.

The current market for equipment, labour availability and fuel prices were also considerably more favourable than when the PFS was completed, and Jameson was expecting to benefit from this change in circumstance.

The company told shareholders that once Jameson has completed identifying and evaluating potential changes to the PFS, the study would be updated and restated.

Meanwhile, the coal developer was also considering the upside potential offered by the Southern Extension, which had not been included in the original PFS. The area is estimated to contain some 23.7-million tonnes of inferred resource, and should additional exploration determine reserves of an attractive quality, could extend the LoM at Crown Mountain by several years.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation