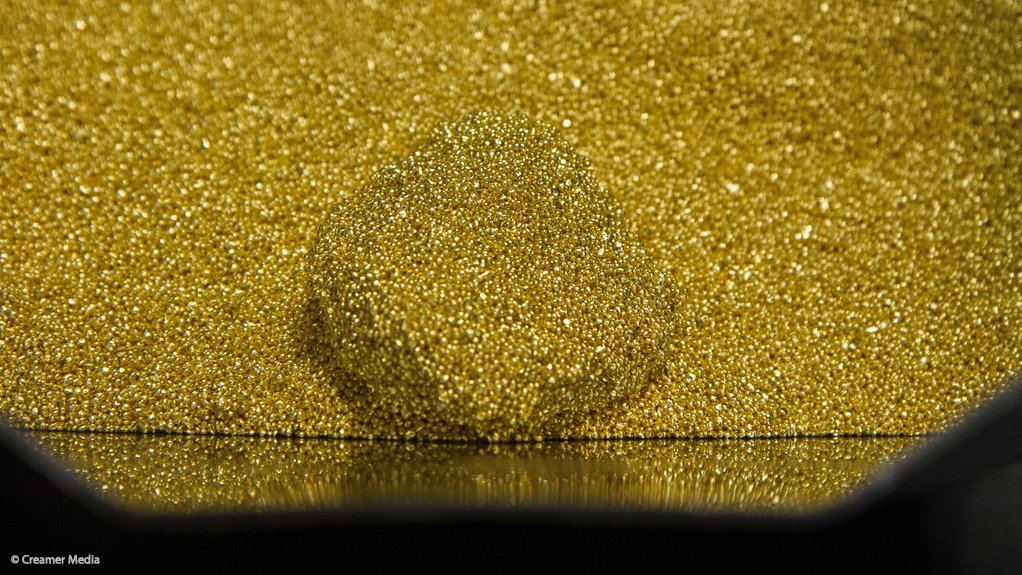

Central banks add 193 t of gold to reserves in H1

Central banks have added 193.3 t of gold to their reserves in the first six months of this year, which is an 8% increase compared with the 178.6 t bought in the same period last year, making it the strongest first half for central bank gold buying since 2015.

The World Gold Council (WGC) states that gold is an important part of central banks’ foreign exchange reserves.

According to the International Monetary Fund, at the end of the first half this year, central banks collectively owned $1.36-trillion of gold, which is around 10% of global foreign exchange reserves.

Central banks are of equal importance to the gold market. In the first half of this year they accounted for 10% of demand.

A few central banks account for a significant proportion of recent purchases. Russia, Turkey and Kazakhstan alone accounted for 86% of central bank purchases in the first half of this year.

Egypt’s central bank recently bought gold for the first time since 1978, while India, Indonesia, Thailand and the Philippines have re-entered the market after multi-year absences.

Meanwhile, Mongolia’s central bank bought 12.2 t of gold over the past eight months and Iraq’s central bank has taken advantage of the lower US dollar gold price to add 6.5 t to its gold reserves.

“Emerging market central banks’ foreign exchange reserves have risen since the financial crisis, with a number increasing their gold holdings too.

“We believe some emerging market central banks could be adding gold to maintain a certain allocation level as overall reserves grow. Recent gold purchases may reflect higher overall foreign exchange reserve balances,” said the WGC.

Looking ahead, the WGC expects central bank demand to remain buoyant, while diversification will continue to be an important driver of demand, as will the transition to a multipolar currency reserves system over the coming years.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation