ARM declares dividend, despite copper price blow, Lubambe trials

Despite the unfavourable copper price faced by diversified miner African Rainbow Minerals (ARM), the company has resolved to remain profitable, declaring a dividend for the year ended June 30, albeit a drop to 350c a share from the 600c a share reported in 2014.

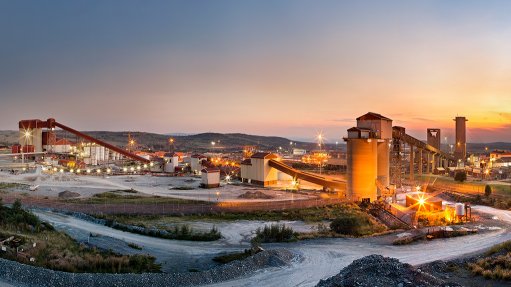

At ARM’s annual results presentation earlier this month, the company stated that it was still in the process of reassessing and finding more cost-effective and productive ways of mining copper at the South Limb shaft at its Lubambe copper mine.

The shaft was placed on temporary care and maintenance earlier this year owing to unforeseen sandbanks indicated on the drilling data and slow ramp-up and build-up of the development, which was compounded by a significant drop in the copper price.

ARM CEO Mike Schmidt said at the company’s results presentation that the company was looking to bypass the sand zone. ARM posted a 58% drop in headline earnings to R1.74-billion for the year ended June.

He added that, principally, most of the access development was in the footwall. “We are going to move all our assets into the hanging wall and we are pretty confident that it will yield the desired results,” Schmidt said.

Meanwhile, the group financial results were “robust”, with cash generated from operations increasing to R2.5-billion from R2.07-billion in 2014. “We are focused on cash management and seeing the results. Costs were well controlled in most of our operations and we have restructuring plans at one or two of our operations, which are already delivering good results. We have cut our exploration expenditure in line with guidance and we have made significant reductions in our capital profile going forward,” Schmidt said.

In line with this, the company’s capital expenditure guidance for 2016 was reduced by R500-million to R2.4-billion.

Also speaking at the results presentation, ARM executive chairperson Patrice Motsepe explained that the company’s basic earnings also dropped significantly, down 97% to R104-million from the R3.28-billion it reported in the previous year.

This, he noted, was due to impairments of R292-million after tax in the ARM Ferrous division, as the Black Rock operation had been experiencing a double-digit increase in costs every year over the last five years. Unit production costs also increased by 17% owing to lower production, increased hauling distances and ageing infrastructure.

The mining project was in the process of reducing its labour complement.

Other impairments included an unrealised market-to-market loss after tax of R534-million on its gold mining subsidiary, Harmony Gold, as well as an attributable impairment adjustment of R784-million at Lubambe.

The revised mining plan at Lubambe deferred ramp-up to full production to 2019 and this resulted in the impairment.

“The global mining industry is struggling and there is a global challenge relating to prices and oversupply in certain commodities. [In] South Africa, we are obviously affected by these challenges, but there are circumstances that are within the control of the mining industry and I’m confident to say the majority of the mining companies are doing a very good job,” Motsepe concluded.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation