Arconic slips, Alcoa gains in market debut; Moody’s downgrade for both

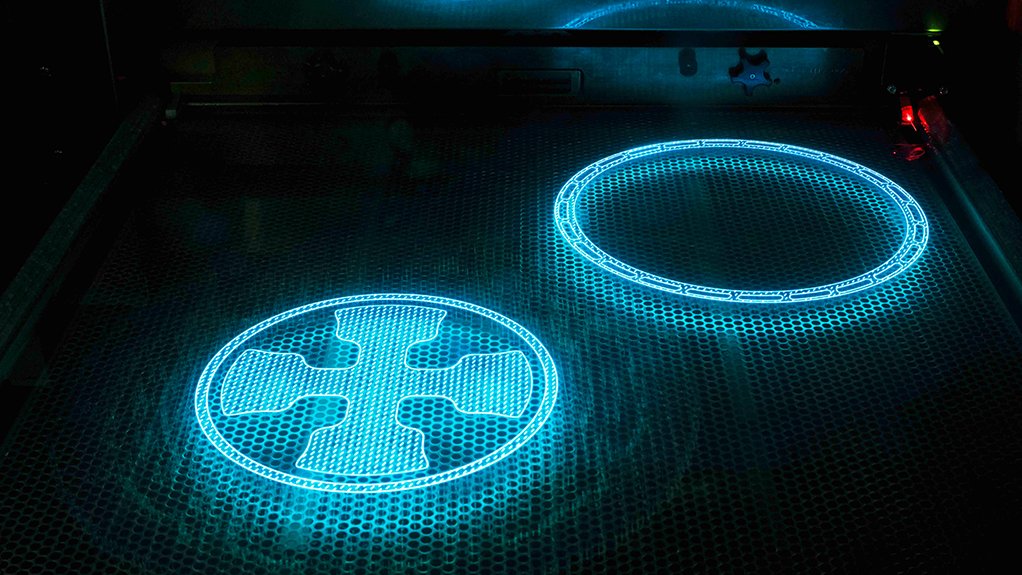

Arconic 3D printed polymer prototype patterns: aero engine components

Photo by Arconic Inc

VANCOUVER (miningweekly.com) – The equities of spun-out companies Alcoa Corp and Arconic Inc officially started trading on the NYSE on Tuesday, charting divergent trajectories and compounded by ratings agency Moody’s Investors Service downgrading the companies' ‘corporate family’ and ‘probability of default’ ratings by one notch each.

In trade in New York on Tuesday, shares of Alcoa – the spinoff that contains the raw-aluminium operation – rose 7.3% to $23, while shares of Arconic — the renamed parent company that houses the company’s businesses supplying the aerospace and automotive markets — fell 12% to $18.92.

Spearheaded by CEO Klaus Kleinfeld, the separation of the 127-year-old company will allow the “launching [of] two leading-edge companies, each with distinct and compelling opportunities, and each ready to seize the future”, Kleinfeld said on September 28, 2015, when the spinout was first announced.

At the time, the spin-out was aimed at capitalising on what had been expected to be the higher-growth business of making manufactured goods, with specialist lightweight alloys, for the aerospace and automotive industries. That business, now part of Arconic, is viewed as having more growth potential because of demand from aircraft makers for fasteners, screws and other automotive body parts comprised of lightweight aluminium alloys.

MOODY’S DOWNGRADE

Following the separation of Alcoa's upstream business from its value-add business, Moody’s dropped Arconic’s corporate family and probability of default ratings one notch to Ba2 and Ba2-PD, from Ba1 and Ba1-PD, respectively.

Concurrently, the ratings on Alcoa Corp’s senior unsecured debt and industrial revenue bonds were downgraded to Ba2 from Ba1. The company's ‘speculative grade liquidity’ (SGL) rating was also downgraded to SGL-2 from SGL-1. The ratings outlook is stable.

Moody’s said that about $8.6-billion of rated debt was affected by the downgrades.

The ratings downgrade was driven by the combination of the higher financial leverage pro forma for the separation, as well as near-term headwinds in the company's higher-growth aerospace segment, and continued (but slower than expected) growth in certain of the company's other end-markets, Moody’s stated.

The action also considered the loss of the company's commodity business, which, although volatile, contributed to higher earnings before interest, tax, depreciation and amortisation (Ebitda) levels supporting the existing debt. It also served as a countercyclical business to the company's value-add manufacturing operations.

The action reflects Moody's expectation that debt/Ebitda (including Moody's standard pension and lease adjustments) will range from roughly five times at separation, improving to four times by the end of 2017.

The improvement is based on the expectation that the company will reduce $1.8-billion of debt over the next three to six months to be accomplished through $1.2-billion of asset sale proceeds (primarily from the spin-off of the upstream and certain other assets that comprise Alcoa Upstream Corporation, renamed Alcoa Corporation) and repayment of the company's $750-million notes, due February 2017. Pro-forma for these actions, debt/Ebitda stands at 4.3 times, compared with the five-times level at separation.

These figures do not include the potential sale of Arconic's 19.9% retained equity interest in Alcoa Corp.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation