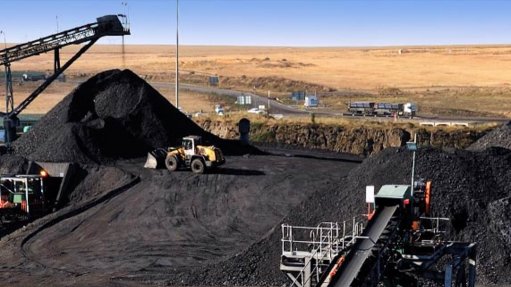

The Uitkomst Colliery

Run-of-mine (RoM) coal production at MC Mining's Uitkomst steelmaking and thermal coal mine, in South Africa, increased by 14% year-on-year to 115 909 t for the quarter ended March 31 – the third quarter of its 2024 financial year.

ASX-, Aim- and JSE-listed MC Mining, which is being bought out by Goldway Capital Investment, reports that the mine sold 75 590 t of high-grade coal during the quarter.

"The Uitkomst Colliery turnaround plan continues to yield very pleasing results, and RoM coal production significantly exceeded the comparative period in 2023. Production at the underground colliery remains challenging due to the geological conditions and extended travel time to the mining areas and unfortunately the mine recorded one lost-time injury during the quarter.

"The international and domestic thermal coal markets remain under pricing pressure and, during the period, the colliery continued to assess alternative marketing strategies, resulting in the signing of an offtake term sheet with Paladar [Resources] in April," MC Mining MD & CEO Godfrey Gomwe comments.

The coal miner reiterates that Goldway's takeover offer of A$0.16 a share was declared unconditional on April 8, and points out that, by April 29, Goldway held about 93.05% of MC Mining's shares.

It expects Goldway's takeover process to be completed on April 30.

Meanwhile, the takeover process adversely impacted on MC Mining's progress at the Makhado project during the March quarter.

This included the suspension of early works and early coal initiatives, as well as the managed tender processes for the selection and appointment of the outsourced mining, plant and laboratory operators at Makhado.

The takeover offer also resulted in the cessation of funding activities for the development of the project.

Activities are expected to be reinitiated once the takeover offer process is complete.

Further, at the Vele Colliery, measures to optimise operations are under consideration.

The mining and processing operations at Vele were outsourced to Hlalethembeni Outsource Services in late December 2022, but it experienced operational challenges in attaining the targeted monthly saleable coal production, while unit costs were adversely impacted by the lack of access to rail capacity to transport Vele's coal to port.

The challenges experienced by HOS were exacerbated by the decline in the API4 export thermal coal price during the 2023 calendar year.

As a result, HOS exercised the hardship clause in the outsource agreement during December 2023 and commenced downscaling operations at Vele. The downscaling was completed during January.

HOS subsequently initiated Operation Shandukani, a production optimisation strategy. The evaluation of these measures is expected to take place in the fourth quarter of the 2024 financial year and is expected to result in improved profitability at the colliery.